New York City is in Danger of Bankruptcy

March 18, 2019

Why is New York City in Danger of Bankruptcy?

New York City, often referred to as the business capital of the nation, is facing one of the heaviest financial burdens we have seen in over 40 years. This financial crisis is comprised of multiple factors including a high tax burden, New Yorks net out-migration, increasingly high public spending, massive government pensions, bond debt, and retirement benefits for government workers. With the mass influx of government spending as well as the current standpoint of the economy, New York could potentially claim bankruptcy if the nation were to succumb to another recession.

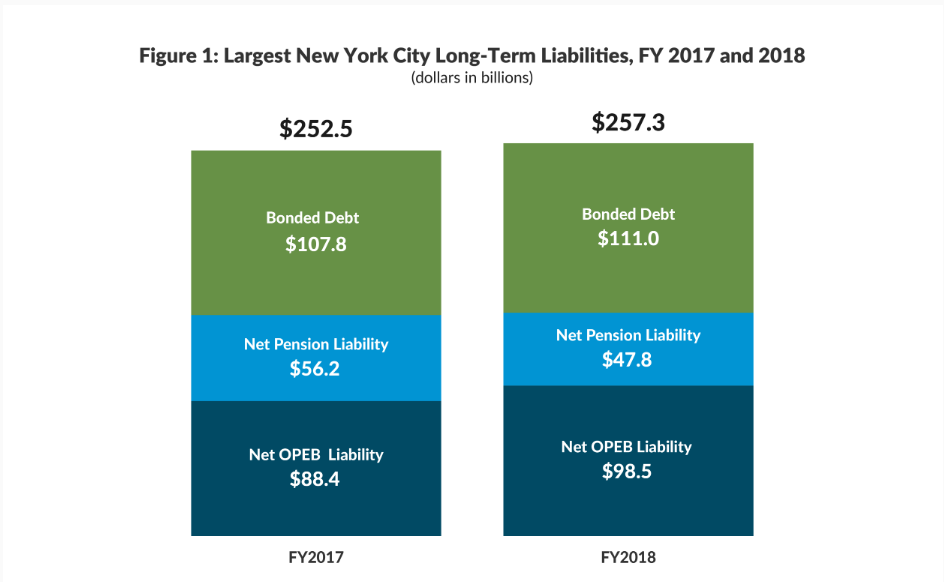

In October of 2018, New York City reported that It spent $257.3 billion in long-term liabilities towards its government officials. These include bonded debts, worker pensions, and retirement benefits for its public sector workers.

In the breakdown provided by the New York Citizens Budget Commission, we can see that the overall increase in government spending has increased from $252.5 billion to $257.3 billion in a single year. While it may not look like a large increase on paper, the rise in spending cost New York City an additional $4.8 billion in annual spending.

Factors Contributing to NYC’s Potential Bankruptcy?

Overspending

With the increased annual spend reaching a high of $89.2 billion, New York City is overwhelmed by the amount of money lost each year. Recently, Mayor Bill de Blasio introduced a new budget that requires an additional $3 billion in spending amidst reaching a historical record deficit of $257.3 billion spent in 2018. The budget aims to save the city a predicted $750 million by the year 2020. Some experts praise de Blasio for the predicted savings, while others are concerned this saving will not be enough if the nation defaults to another recession.

Long-term Liability

In the accounting world, long-term liability refers to the commitment to provided payments to a party or individuals in the future. Normally, these “liabilities” are in the form of bonds, which is a legal provision for a company, government or other benefactors to pay a set value to an individual or organization over time. Unlike standard bonds that have a set payment date, typically 12-months, long-term liability bonds have no obligation for an exact payment timeframe. The bond is simply slated to for return once the company or government turns a positive profit.

The danger lies in the accrued interest these bonds generated over multiple years, which increase the payment threshold for the individual or company in ownership of the bond.

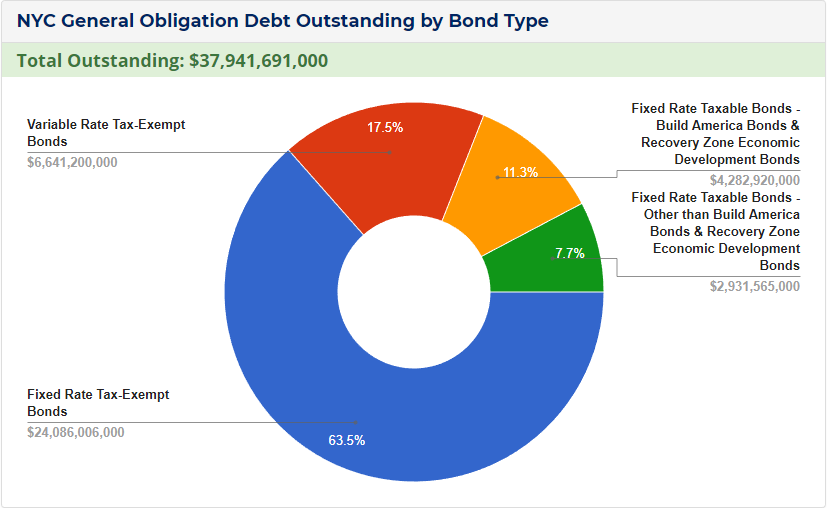

A breakdown provided by the City of New York, Department of IT & Telecommunications gives an overall look at the total outstanding debts required to be paid back in full by the city of New York over time. A majority of these bonds are tax exempt, removing any chances of New York to recover most of its lost assets.

Each year, New York City will be required to pay off part of this outstanding debt to keep afloat amongst ever-increasing interest generated from these outstanding bonds. As the year’s progress and the interest of these debts rise, New York City will be required to spend more in annual spending to offset these costs.

High Public Spending

With the large increase in the overall population from average births and immigration, and the decrease in residents continuing to occupy the city, the requirement for higher public spending is required. Over the past five years, New York City has added more than 33,000 public sector workers out of necessity. Public spending consists of Healthcare, Public services, education, sanitation workers, construction of public schools and general maintenance.

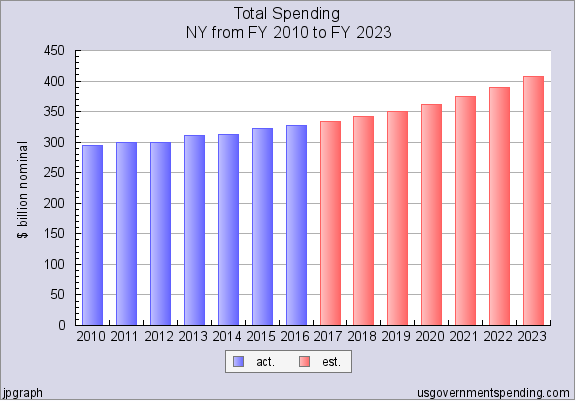

The provided graph details the total cost and estimations yearly from 2010 to 2023. Although this graph was generated in 2016, the estimations provided for 2017 and 2018 were in the ballpark of the actual amount spent. If the trend of the projected increase continues, New York City could be looking at a potential high of over $400 billion in yearly spending.

Net-Out Migration

Net-out migration refers to the number of New York City residents and occupants electing to leave the state. As the debt is rising, the total amount of New York City residents is declining. According to the NYPost, between July 1st, 2017 and July 1st, 2018 New York City had a population decrease of 48,510. While this may not seem like a detrimental amount amongst the estimated 19.5 million individuals currently occupying the city, the increased loss of residents correlates with the amount of state tax revenue brought in annually. Considering 60% of New York’s state tax comes from Income tax, the loss of residents over time will impact the annual revenue generated.

Repair of the L Train

Starting on April 27, 2019, the L train will be shut down for 15 months to repair the damage caused during Hurricane Sandy back in 2012. Currently, approximately 300,000 individuals use the L train daily to commute to work between Manhattan and Brooklyn. This repair has an estimated $477 million price tag, which is a large sum of money to allocate during an impending bankruptcy filing. With a projected $435 million in revenue generated from the L-train in 2019, the cost of the repair will exceed the revenue brought it from the L train itself.

The shutting down of the L train also correlates with the number of new residents expected in 2019. With a lack of convenient transportation, many will delay their migration into the city.

What Happens if a City Files for Bankruptcy?

As the likelihood of a city-wide bankruptcy is rare, there is a large concern surrounding what will transpire if the city were to file. Since there has never been an occurrence of New York City officially filing for bankruptcy, we can only determine what may transpire based on other city’s who have gone bankrupt in the past. If we are to look at the events that transpired following the bankruptcy filings of Vallejo, California, we may have an understanding of what may transpire. Unfortunately, the largest of these potential hardships due to bankruptcy will fall on the shoulders of city employees. Those taking the biggest hit will be the city’s retired workers, as the city could potentially cut back on its offerings to retired employees. These cuts have included reductions in health benefits and pensions offered to those retired and looking to retire.

Bankruptcy is not an instantaneous process either. During Vallejo’s filing in 2008, the city and its officials were subjected to a grueling multi-year process before the bankruptcy was finalized. The simple act of filing for bankruptcy affected unions, creditors and other services reliant on the city’s support for its continued operation. In the event of bankruptcy, New York City would be required to re-negotiate its contracts with these individuals to spend fewer expenses. This process of negotiation and lack of funds may go on for years, while other cutbacks to government operated public services such as the police force will result in a large budget decrease.

Is the Nation in Danger of a Recession?

When it comes to analyzing recession occurring in this nation, it is always a result of a trigger. A trigger is commonly defined as something that has occurred that impacts the direction of the economy. In 2007, we saw a large decline in the housing market which was the trigger that resulted in a recession. With the current state of the economy as well as the increasing political affairs, many are speculating that the occurrence of a recession in 2019 could be imminent. The most prominent of these reasons came from the extended government shutdown that created a standstill in the nation. With the government shutdown resolved after an extensive 35 days, justification to this determination as a reason for a shutdown was nullified.

The second reason many experts are stating as a potential cause of a recession comes from the imposed regulations on trade. As trade between US and China comes to a slowdown, development, and advancement between goods and technology is coming to a standstill. With the introduction of tariffs between the US and China, there is worry that additional tariffs may be imposed with other trade nations. This may introduce the potential of a trade war to ensue, causing a large impact on the American economy.

The final reason for a potential recession is due to a mistake made by the Federal Reserve earlier in the year. This is due to the Fed attempting to stabilize the large increase in government stimulus created from the height of the stock market earlier in the year and the worry there will be a decrease as the year progresses. The danger comes from the Federal Reserve raising interest rates at the wrong time, essentially jumping the gun and increasing the chances of a recession.

The determination for this claim is backed by the dramatic rise and fall of the stock market. While the S&P 500 market dropped 20% below its peak on December 24th, 2018, it has since managed to rise to 14% below its peak. The Dow Jones was another contributing anomaly, as we were met with a record drop on Christmas Eve, and awoke to a historical high on Christmas Day.

While the increase in interest pushed as a result of the stock market may not cause a recession alone; combined with any other trigger almost ensure a recession will occur.

What’s Next for New York City?

Unfortunately, it is too early to tell what may come from New York City’s financial situation. With the imminent danger of bankruptcy, we will see a shift in how lawmakers attempt to fix the budgeting issues. This is not the first time New York City has found itself on the brink of a financial collapse, and it certainly won’t be the last time. With attention now drawn on the city, it may be the exact pressure needed to create a more financially responsible decision to prevent a larger decline.