Saudi Arabia’s Oil Prices are Rising – What It Means for America

November 12, 2018

Saudi Arabia has been in the news quite a lot lately. Whether it would be the controversy surrounding the disappearance and assassination of the Saudi Arabian journalist Jamal Khashoggi or its involvement in the Yemeni Civil War, the Kingdom of Saudi Arabia hasn’t been able to get enough media coverage.

The Kingdom made headlines on November 12, 2018, after Saudi energy minister Khalid Al Falih informed the world at a conference in Abu Dhabi that Saudi Arabia’s oil output will fall by 500,000 barrels per day in December of 2018. Additionally, he added that members of the Organization of Petroleum Exporting Countries (OPEC) could reduce supplies as well if it’s needed.

The United States and Crude Oil

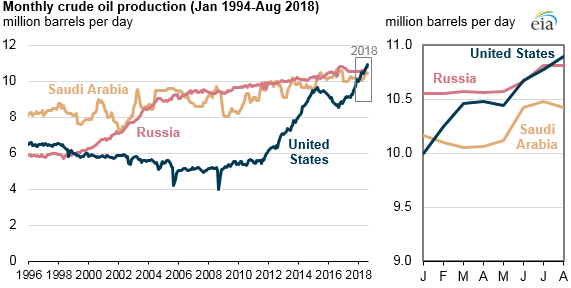

For many years the United States has depended heavily on foreign imports for energy sources, including Saudi Arabian produced oil. This dependency has been decreasing as of this year after the United States reclaimed the title of the largest global crude oil producer in 2018, surpassing both Russia and Saudi Arabia.

Many have feared the prices of oil rising as a result of the United States sanctions imposed on Iranian oil, as prices of crude oil began hitting four-year highs of more than $80 a barrel in late September & early October.

Now with the decrease in production announced by Saudi Arabia, many predict that prices may hit well over $100 a barrel. This trend may have been slowed down due to the United States offering sanction waivers to countries such as India, South Korea, China, and Japan to continue purchasing oil from Iran without any consequence.

What Does This Mean for America?

The United States experienced a rise in the cost of gasoline ahead of its midterm elections last week. As prices continue to rise, the United States should expect the cost of gasoline to continue to rise throughout 2019 – especially if OPEC members cut back on their production as well.

The United States definitely could have felt a larger price increase had it not been for its dominance in global crude oil production.