Saving for Retirement Could Pose a Large Problem for Most

January 31, 2019

Depending on the age you are currently, it may be time to begin saving for retirement yourself, instead of relying on the instability of the government to subsidize your retirement. But, with a majority of employers offering full-time employees the option to pay into a 401k, or independently joining a Roth IRA, you may think your funds are all set. This may be true for most, but there is a vast majority who aren’t able to benefit from these programs. This is where independent savings come into play and maybe a greater benefit in the long run.

Why Aren’t People Saving for Retirement?

There is confusion when it comes to most of the articles posted about retirement and those looking to retire, as there is normally a statement saying no one is saving funds at all. This is not true, as only an estimated 42% of adults are neglecting to save for retirement, as opposed to the remainder that is. But the problem we are facing is not entirely that some haven’t been saving for retirement but rather that they haven’t been saving enough to sustain themselves after leaving the workforce. When it comes to saving money in their individual 401k’s or IRA’s, the thought of sustainable Social Security payout was always considered, which lead to a smaller portion of funds to be sent to their individual retirement funds.

This neglect of saving will prove to be more challenging as the days of steady income become shorter, the need for a higher amount of saving will be required. Though, the fault cannot completely fall on those with smaller savings since the promise of Social Security was always made to them. The harsh reality is that there will be no government subsidization, and this will cause difficulty in the late stages of life that should generally come with no hassle.

Millennials and Retirement Savings

Since as early as the elementary school the expectation of independent savings has been a top in the forefront of any Millennial’s psyche. There was a repeated scoff from a majority of teachers claiming that Social Security won’t exist by the time we would be eligible to collect. This didn’t really resonate with most at such a young age, but as career ages finally set in there is a reality shown that those teachers were right.

Social Security is at a diminishing point and will most likely not be around for Millennials or younger to claim anything from it. This is why it is imperative for many to begin saving funds independently at as young as 25 to have any kind of cushion to fall on in their later years.

Saving Independently

As we touched on both 401k’s and IRA’s there is a large majority of downsides attributed to both of these investment accounts. One true independent way to guarantee that money will be accessible to you in any stage of life is to open up a sperate savings account and begin saving for retirement early. This allows you to allocate however large or small of an investment you could provide on a monthly basis.

If you are 25 and you are able to allocate $400 a month into a savings account, you will be setting yourself up for a stable retirement. Of course, provided you find a savings account with a decent yield on interest, so going with your first stop isn’t recommended. Depending on the savings guide you find online there could be varying and dated information as some claim to find banks with a 7% yield of interest, but in reality, the highest available to the public currently is provided by Goldman Sachs bank at 2.25% APY, Synchrony Bank with a 2.20% APY, Barclays bank with a 2.20% APY and finally American Express Personal Savings coming in at 2.10% APY. This is far off from the 7% figuration provided from other publications and will provide more of a realistic expectation when it comes to saving independently.

The Breakdown of Independent Savings

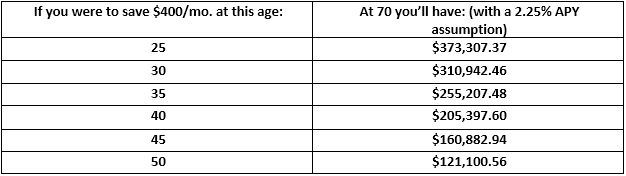

With the figuration provided by the current 2.25% APY, we have provided a tabled estimate of savings over the years.

For one, this chart created a valuation of savings at a retirement age of 70. This is an additional push back of about 4 years as opposed to the current retirement age of 66. This is an unavoidable reality, as prices for nearly everything increased by a large percentage over the last few years. Even with a $373,307.37 total for retirement, you will still find yourself in need of additional funding, or to have a joined retirement fund with your spouse.

If you are beginning to look into a customized savings plan and age you could visit an online retirement calculator.

For Those Currently Working

For those that are currently in the age range of 40-50 and have no saved retirement fund, there may be no avoiding working until 70, and possibly beyond. This is a harsh reality most have to come to terms with as the age of retirement is slowly rising year by year and the set “age” is becoming more of a recommendation the more the cost of products and cost of living rise.

Where to go from here

If you already have a savings plan set up and are on a steady track, you are making your first good steps. A ton of guides online suggest investing in stocks, but with the state of the stock market currently, there is no stability in going in blind, especially if you don’t have a ton of money to willingly invest into a business venture that could leave you underfunded.

The best next steps to take would be to increase monthly funding at any available chance, even if it is only an additional $100. This would increase your monthly yield by a vast amount and provide a more comfortable retirement fund. Keeping your eyes peeled for any increase of interest at banks could also provide you with a better APY overall.